World Agri-Tech London: 3 Thoughts with Julia Lechner

Julia Lechner’s thoughts on World Agri-Tech London and a note looking forward to San Francisco.

Banks are increasingly turning to fintechs to stay competitive, innovate and deliver enhanced services to their customers. But not all agfintechs are the same. The process of selecting the right partner can be a complex undertaking that requires careful consideration and strategic planning.

by Agrograph

October 30, 2023

As the value of farmland continues to soar, ag lending is becoming a compelling investment. However, many traditional financial institutions are reluctant, primarily because they are unfamiliar with the industry.

Unlike traditional risk assessment processes for commercial loans, agricultural lending requires additional farmland-specific data points, that are not reported by analytics companies, publicly available to investors, or standardized by any measure.

This means financial institutions are looking at fintechs for additional farmland resources. As the space becomes increasingly crowded with tech companies “band wagoning,” the pool of credible agfintechs remains small.

In this Bank Business News article, Jim O’Brien assesses five critical factors during the data vendor evaluation process to ensure a successful fintech partnership, since not all agfintechs are the same.

Read more here!

Agrograph is a global agrifintech company that delivers data-based solutions to companies with exposure to agriculture. Agros® Solutions empower companies invested in agriculture to drive important business decisions, manage risk, and capitalize on opportunity. Agrograph is the Credit Score of Agriculture.

Julia Lechner’s thoughts on World Agri-Tech London and a note looking forward to San Francisco.

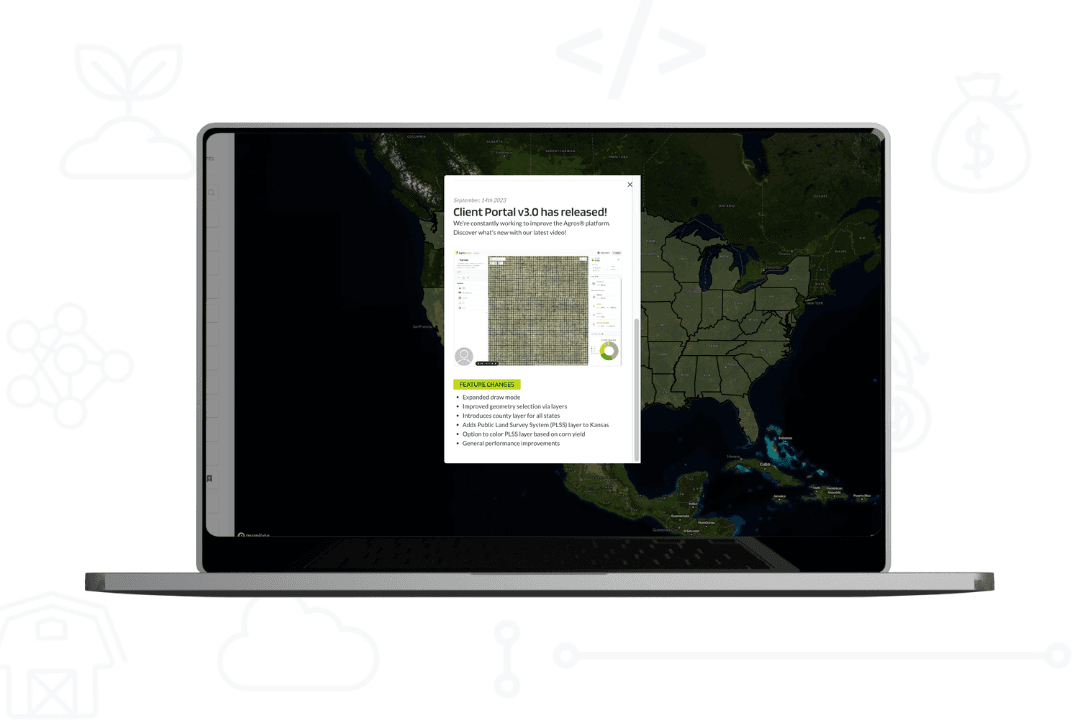

Today we’re announcing the release of the Agros® Client Portal - a powerful analytics platform that transforms geospatial data into agricultural production intelligence and automated decision support solutions at scale.