From Six Days to Six Minutes: Reimagining Data Validation for Land Appraisals

Agros® technology gives lenders access to validated data resources to support the land appraisal and loan approval process.

The Agros® Risk Score allows virtually any financial institution to approach the agricultural industry with confidence and competence.

by Jaclyn Roberts

October 01, 2021

Customers crave connection and convenience (Hello, Amazon!), a role many financial institutions have embraced through online technology. In fact, research from 2019 found that 67% of borrowers completed a portion of their loan application online, an increase from 56% in 2016, and digital banking is projected to rise to more than 3.6 billion by 2024. To remain competitive among modern farmers, agrifinance institutions must embrace digital banking practices, by sharpening the digital prequalification or preapproval processes. This can bring challenges.

Lenders are responsible for aggregating and validating personal data and reports in real time. This has become feasible using personal credit scores, asset to debt ratios, and income streams, which can all be aggregated and verified instantly for the everyday borrower. However, when evaluating creditworthiness in agriculture, vital factors such as field-level performance and earning potential aren’t accessible on demand.

So how can agrifinance institutions scale and adopt these on-demand approval systems for today’s modern farmer?

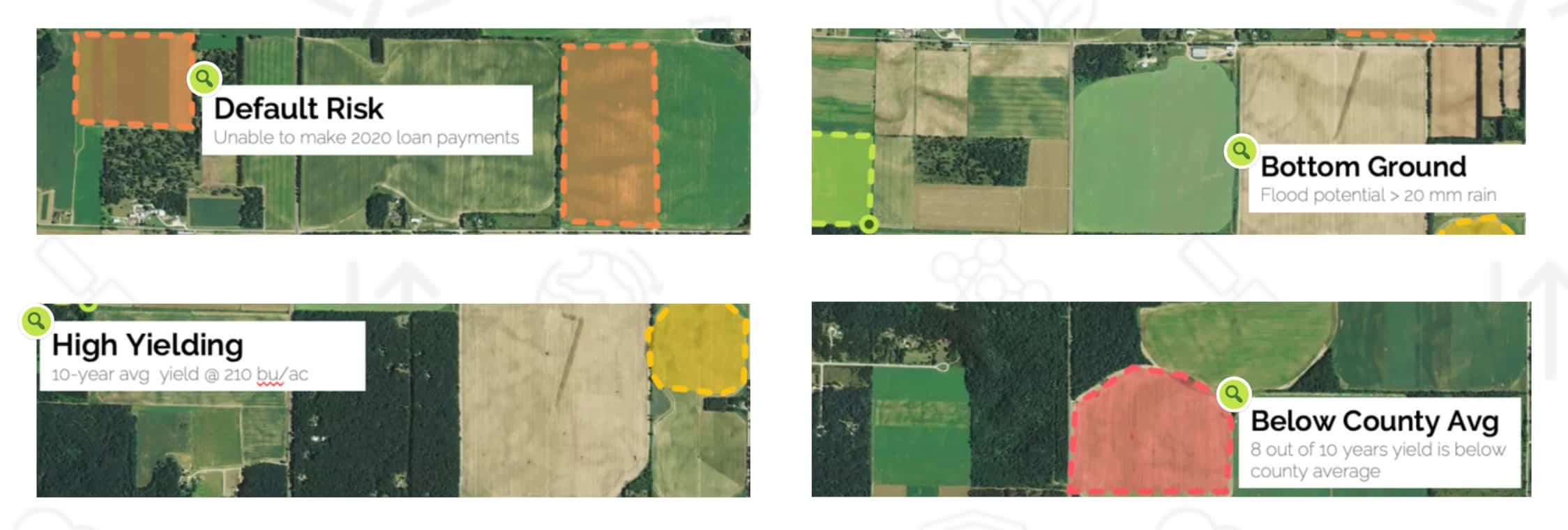

Agrograph developed the Credit Score of Agriculture, an instant credit decisioning solution delivered using Agros® technology. The technology considers farm-level risk factors that impact financial and operational success in agriculture. This includes metrics such as land use, yield data, market demand, and other scientifically validated environmental factors that impact the potential production and profitability of land.

The Agros® Risk Score provides farm-to-farm creditworthiness ratings ranging from one to five for individual farmers across the United States.

The Credit Score of Ag delivers a custom score for farmers based on accurate, verified data. Ranging from one to five, the score provides a snapshot of a farm’s performance over a historic time period, a number that can be customized by lenders. When combined with traditional credit assessment tools, lenders can streamline digital prequalification and preapproval processes for borrowers operating in the agricultural space ultimately enhancing the borrowing experience and deliver a seamless and expedited lending process for its customers.

The application of Agros® technology across lending platforms does more than simply improve customer experiences. This solution helps lenders manage a very volatile industry for financial institutions.

By incorporating the Agros® Risk Score, lenders receive a standardized metric to evaluate their full agricultural portfolio. In other words, it gives lenders insights to the health of an agricultural portfolio.

By aggregating and examining the AGROS® Risk Score across all clientele, lenders can actively monitor and manage the risk level within their agricultural lending portfolio.

Agriculture’s niche market makes assessing risk difficult. Only a handful of financial institutions have the background to understand the complexities associated with the industry and properly assess and manage agricultural loans. The Agros® Risk Score removes this barrier and allows virtually any financial institution to approach the agricultural industry with confidence and competence.

“Farmers don’t have the same financing options as other business ventures. The Agros® Risk Score opens the doors to more credit for farmers and more favorable interest rates that better reflect the risk of their operation.”

- Jim O’Brien, Co-Founder|CEO, Agrograph

Learn more about the Agros® Risk Score by contacting us today.

Jaclyn Roberts is a Texas native with strong ties to the agricultural industry. She is the Marketing Coordinator at Agrograph.

Agros® technology gives lenders access to validated data resources to support the land appraisal and loan approval process.

The Agros® Sustainability Score provides a standardized sustainability rating for any field around the world.