by Jim O'Brien

June 22, 2019

As the wettest 12-month period on record haunts the Corn Belt, farmers in the Midwest struggle to choose how to manage an inevitable loss for 2019. While some farmers may gamble on a late-planted crop that could yield a fraction of a typical harvest, many will turn to crop insurance that pays out when farmers are unable to plant.

This means big lifts for federal crop insurance providers (AIPs) and insurance agencies across the country who will dedicate time to identifying eligible acreage for “prevented planting” claims, as well as traders and analysts grasping for information to predict future market conditions.

Agrograph, a solution-focused agricultural data company, holds the answer to the puzzle. Agrograph supports crop insurance providers, agencies, and their adjusters processing prevented planting payments through Multi-Peril Insurance Claims (MPIC), the policy covering many impacted farms in the Midwest, by supplying reliable field-level data through its online platform.

The U.S. Department of Agriculture (USDA) supplies the industry’s primary data now, but its estimates have limitations. For example, reports estimating acres of corn planted in the U.S. reflect farmer intentions, a moving target that changes weekly. For those hinging high-dollar decisions on these numbers, reliable data is key.

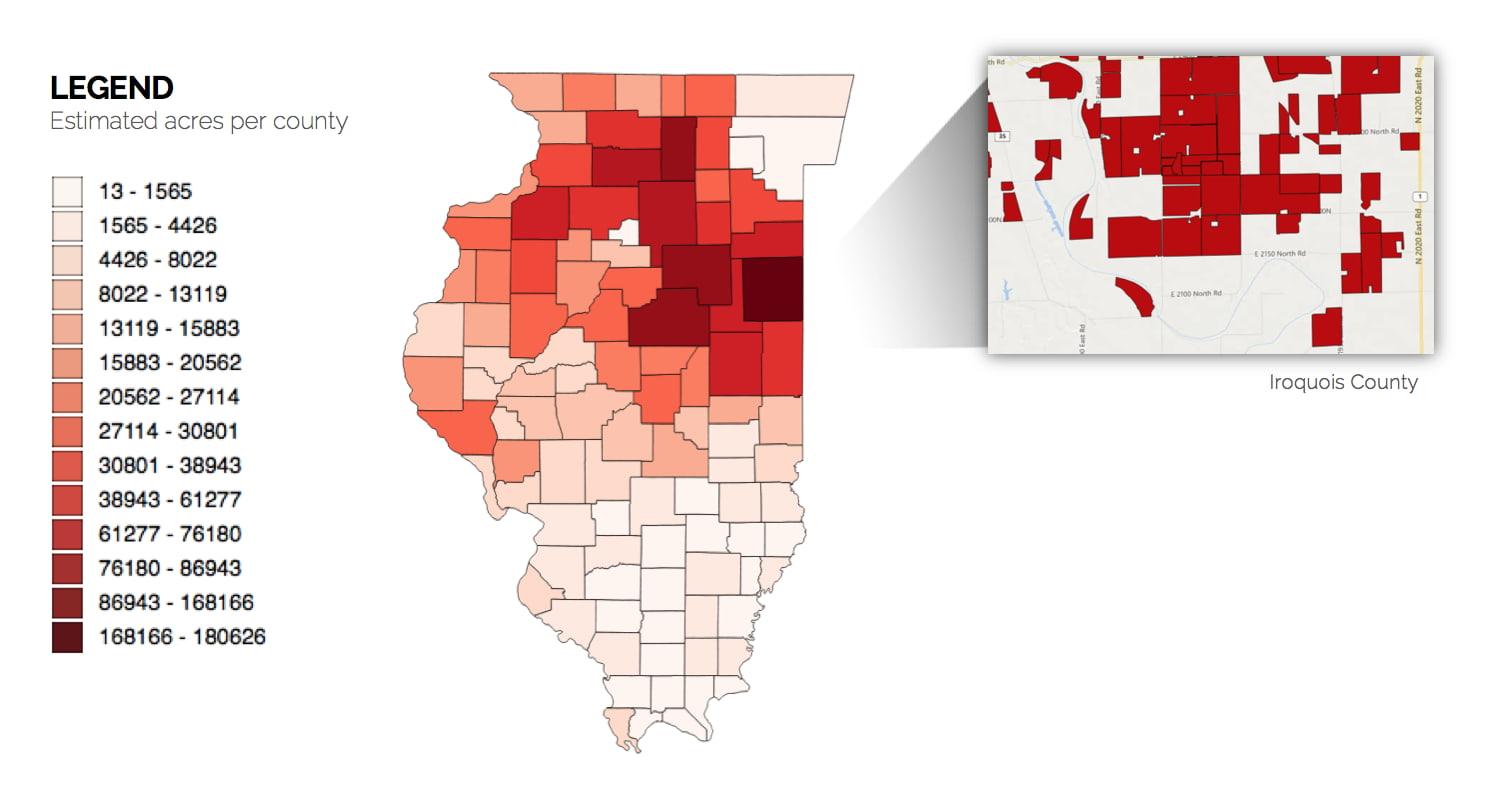

“The USDA estimates between 5 million and 15 million acres of corn are eligible for prevented planting claims,” said Mutlu Ozdogan, founder of Agrograph. “That’s a big margin of error. Agrograph’s data accounts for regional and geographic factors such as final and late planting dates to create field-level estimates the industry can rely on.”

Agrograph estimates 2.2 million acres of corn may be eligible for prevented planting claims in Illinois (Figure 1).

Agrograph visualizes the geographic spread of the loss for crop insurers, modernizing the traditional approach,” explained Ozdogan. “AIP’s no longer have to wait to aggregate information collected from the windshield of the adjuster’s pickup truck to understand what is happening at the field level.

The traditional model to identify eligible prevented planting acres begins when farmers contact their crop insurance agent. The agent reviews policy coverage, production practices, and the crop, and if the loss meets the MPCI criteria, it triggers the claims process with their AIP.

Rather than piecing together reports and manual records, Agrograph’s solution aggregates the data instantaneously, creating a value-add for insurance providers and insurance agencies focused on quick turnaround and painless experiences for their farmers.

“We see AIP’s use our tool a variety of ways - to mitigate underwriting losses and to ensure policies are consistent and fair for farmers as well as making reporting more efficient and streamlined,” said Ozdogan. “Service and speed represent critical factors that impact bottom lines and determine customer loyalty for an AIP.”