Agrograph Closes Latest Funding Round for Agricultural Risk Rating

August 30, 2021

Investors back the Credit Score of Agriculture and risk management technology by Agrograph.

Agros® technology gives lenders access to validated data resources to support the land appraisal and loan approval process.

by Jaclyn Roberts

September 20, 2021

Land is among the most valuable assets of farmers, but its value is the most challenging and time consuming to accurately assess. This becomes increasingly important as financial institutions seek to properly manage risk across their lending portfolios. To best manage this risk, they focus on accurate loan-to-value (LTV) ratios that compare the cost of a loan to a fair market value of a property.

Land is rapidly developing across the United States. In fact, The American Farmland Trust found that 11 million acres of farmland and ranchland were converted to urban and highly developed land use or low-density residential land use during a 15 year period between 2001 and 2016.

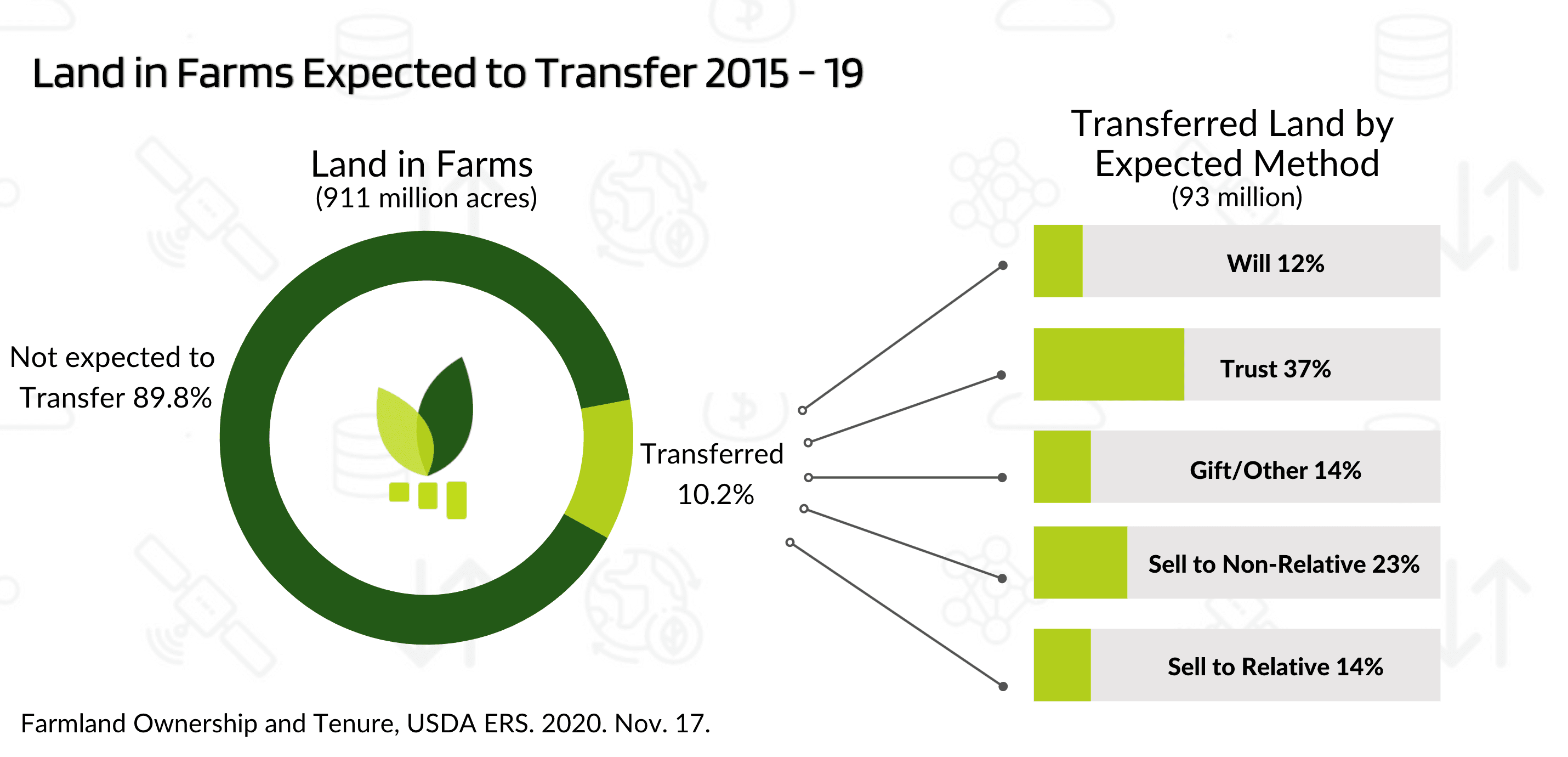

These changes dramatically influence the fair market value of agricultural real estate. Today, farm real estate values have increased by more than 70% since 2006. As land becomes more scarce, demand increases, causing rises in land values. With 2,000 acres converted from farmland daily, it is critical to access reliable and updated data for land appraisals. This will be extremely critical for agrifinance lenders in the coming years as landowners retire.

Real estate financing will represent a major portion of active loans for agri finance institutions in coming years due to increased rates of turnover among farmland due to ageing farmer populations.

Professional land appraiser shortages add an additional layer of complexity to the land appraisal process. A lack of appraisers can slow down rural real estate transactions. This in turn creates poor customer service through delayed closings, and creates unnecessary risk for financial institutions through extended rate locks.

Agros® technology gives lenders access to validated data resources to support the land appraisal and loan approval process.

For example, working with an ag lender to deliver an automated land classification tool, data can be inputted into an internal risk model to allow for more reliable land classification information and expedited LTV ratios. This streamlines the traditional manual reporting process that requires validation from the U.S. Department of Agriculture, Farm Service Agency, platt books, county offices and many other decentralized sources.

Rather than running a manual appraisal report that might take up to 6 weeks, the land classification report was able to generate accurate acreage and land use through one simple step.

In the past, identifying land use meant an appraiser must dig for data and hope that it's accurate - a process that could take six days or even six weeks. Agrograph’s land classification technology speeds up the land appraisal process, giving agrifinance professionals access to verified data faster than ever before.

- Jim O’Brien, Co-Founder|CEO, Agrograph

Jaclyn Roberts is a Texas native with strong ties to the agricultural industry. She is the Marketing Coordinator at Agrograph.

press release

August 30, 2021

Investors back the Credit Score of Agriculture and risk management technology by Agrograph.

user story

October 01, 2021

The Agros® Risk Score allows virtually any financial institution to approach the agricultural industry with confidence and competence.