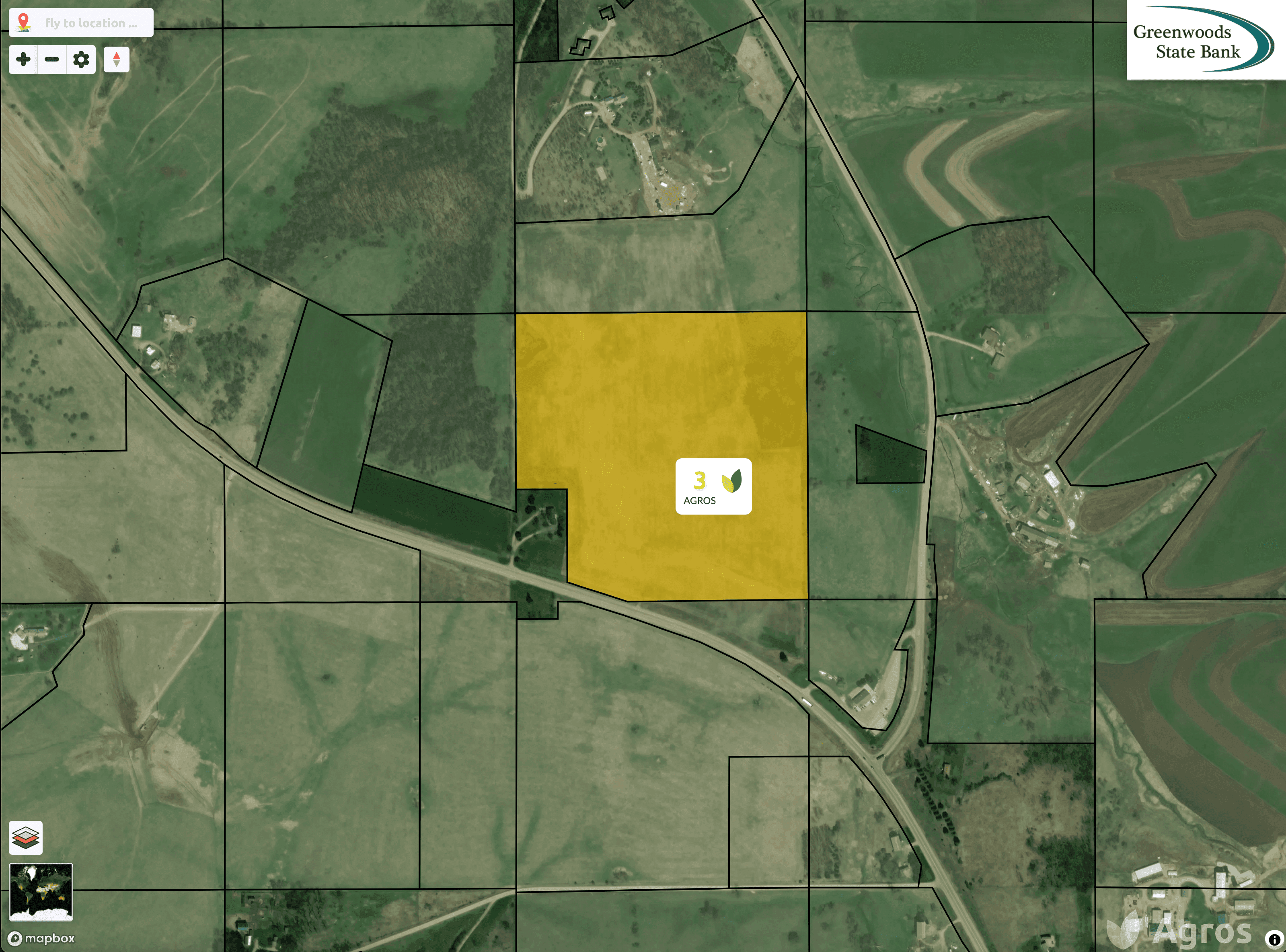

Gear Up for the Agrograph Parcel Report

June 29, 2021

Access field-level insight at the click of a button with Agrograph’s proprietary Parcel Report.

The Credit Score of Agriculture empowers agribusiness like never before. Streamline important decisions with the Agros® Risk Score.

by Miranda Schavrien

August 05, 2021

Assessing risk for the agricultural industry requires a different approach. Determining the risk of an agricultural investment decision isn’t as straightforward as running a FICO credit score or just looking at financial statements. Variables like weather patterns, historical yield production and management practices, impact risk and create unique challenges for calculating the lost cost or interest rate for an operation. Now with Agrograph, finance meets the farm, right in the field.

Agrifinance brings unique challenges and complexity driven by the need for access to farm financials along with farm production information, neither of which is standardized nor structured for ease of use. Collecting all the relevant information needed to adequately assess farm risk is often a manual, time-consuming and error-prone process. The Agros® Risk Score calculates the earning potential of your agricultural assets to empower risk-based pricing models.

The Agros® Risk Score is calculated through Agrograph’s Agros® platform where scientifically validated data like climate, crop and land management practice information, combine with machine learning and artificial intelligence to identify and replicate field-level patterns to produce the Credit Score of Agriculture.

The old adage time is money holds true no matter your business model. As an ag lender, crop insurer, ag service company or specialty financer, looking for ways to improve your accuracy and expedite your processes is always a priority. Agrograph’s Agros® Risk Score automates the onboarding and standardizes the underwriting process saving you time and resources that you can apply to gain a competitive advantage.

Take a look yourself - give our platform a test drive!

Agrograph is a global agrifinance company delivering commercially viable and highly scalable data solutions for the industries supporting farmers.

Miranda Schavrien has served both national and state level agricultural organizations maintaining stakeholder relationships and managing outreach efforts. She is the Senior Marketing Strategist at Agrograph.

insight

June 29, 2021

Access field-level insight at the click of a button with Agrograph’s proprietary Parcel Report.

media

August 23, 2021

Our co-founder and CEO sat down with Phil Lempert, U.S. Farmers and Ranchers in Action for the latest episode of Farm Food Facts on August 18, 2021.